Claims processing is a mission-critical task for any insurance firm. Traditional claims processing has become a challenge because of the time and effort insurance agents have to spend on sifting through documents to find errors, assess risks, and make sure customers receive adequate coverage. The result often involves mistakes that may lead to high payouts and lost customer confidence in the business.

Robotic process automation (RPA) involves using programmed bots to act as digital workers and take over a business process's mundane, repetitive tasks. Such technology can help insurance companies automate their claims processing, making the process faster and efficient

The article below provides in-depth details into claims processing and how robotic process automation (RPA) can improve the entire workflow.

What is claims processing?

Claims processing is the procedure of an insurance company to check the claim requests made by healthcare providers for sufficient information, justification, and authenticity. How does claims processing work? The process begins when a medical provider submits a request to an insurance firm.

The insurance company then checks the information and decides whether to reimburse the entire expenses or just one part of the claim to the healthcare professional. The firm can also reject a claim when it does not follow policy rules or gets identified as forged.

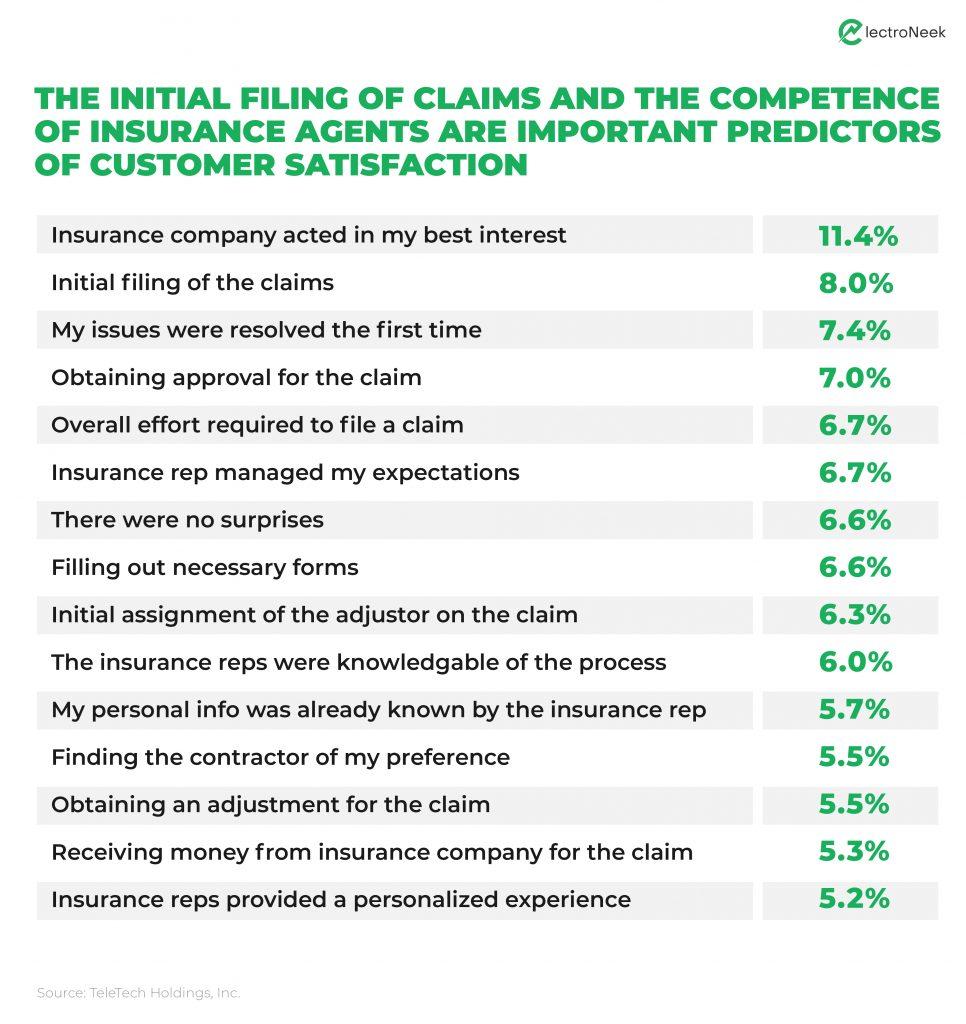

A TeleTech P&C Customer Satisfaction Survey found that average satisfaction levels depended on the efficiency of the initial claims filing process. The image below displays that initial claims filing process and the competence of insurance representatives ranked the highest in terms of customer satisfaction levels.

The research findings in the image above displayed that the initial claims filing process and the competence of insurance agents play an important role in improving client satisfaction levels for insurance companies.

Here is where RPA improves claims performance. By implementing RPA bots, insurers can increase accuracy and efficiency while allowing the staff to focus on strategic work. Sixteen case studies by McKinsey & Company displayed that with RPA increase in ROI within one year can range between 30 to 200%.

Challenges in claims processing

The manual process of claims processing is slow and faces numerous hurdles. A few of the main challenges are explained below:

Heavy operational expenses

RPA reduces the day-to-day costs of insurance companies by allowing bots to take over the manual process. Automation eliminates errors, decreases employee turnover, and provides 24/7 operation with no downtime.

Lack of consistent delivery

Manual claims processing often lacks consistency and efficient management of tasks. For instance, an insurance agent can calculate different payout results for identical claims which leads to customer dissatisfaction. In addition, without proper time management, delays and inaccuracies can occur in identical claims where one case is given priority over the other.

Increased level of fraud claims

Fraud is a major global problem in the insurance industry. Such malicious claims add strain on process management as a lot of time must get dedicated towards analysing the authenticity of claims.

When conducted manually it takes a long time, and may lead to costly errors and misinformation in claim prediction. RPA is a great solution as it can automate the pre-scanning of a claim and verify if it is valid before analysing risk factors with minimal manual intervention.

Poor data integration

Data integration is the technical process of combining the data derived from multiple sources to provide a unified, central view of the data for a business. The main concern related to data integration is dealing with inaccurate and outdated data that negatively affect payments and customer satisfaction while stressing the IT department to manually maintain all the integrations.

Increase in customer expectations

Simply putting your processes in place is no longer enough to satisfy customers. Rising trends, such as online claims management have become the norm. Plus, with more innovative players entering the market, only focusing on policy pricing and quality is not enough to retain customers. The entire claims management process as experienced by the client plays a major role in customer retention.

How to improve claims handling? Insurance claims process automation remains the most efficient solution to solve most of the above challenges. By allowing bots to undertake the heavy lifting of claims processing, insurance companies can derive consistent and quick results every time. In addition, RPA technology lets companies connect disparate claims processing systems to ensure efficient data integration.

How RPA streamlines claims processing: Tasks to automate

RPA for claims processing focuses on closing the gap between legacy systems and improving operational efficiency to improve the overall client experience. Additionally, it allows for human-in-the-loop automation, which refers to the ability of a team to interact with bots where required for maximum efficiency.

RPA bots can take over several functions in automated claims processing insurance. Some of the critical functions of automation in claims processing that vastly benefit insurance companies are:

- Copying and entering data from one system to another

- Reconciling and verifying claims data

- Opening and gathering data from emails and inputting it into the core system

- Using workflow automation with set rules for fully automated processes

- Artificial intelligence (AI) insurance claims paired with RPA increase the overall bot capabilities

- Cognitive automation in insurance helps analyze images, audio, and natural language texts in the claims process

- Scanning data from PDFs

Automated claims processing: Benefits

With RPA, insurers can improve both customer-facing and back-office services. Automation claims processing not only keeps customers happy but also makes sure that your employees are not stuck doing mindless data entry. Listed below are the benefits RPA provides your insurance business:

Quick claims processing

The manual process of gathering information from many sources and documents and putting it into other relevant claims processing systems takes a lot of time. The same process can be completed faster with an RPA bot in just one click, ensuring clients get quick responses when they file a claim. For instance, a bot can streamline the complete claims procedure right from the First Notice of Loss (FNOL) to adjusting and reaching the settlement.

High customer satisfaction levels

Claim processing using RPA provides a wide variety of data enriched processes from onboarding clients to policy cancellations. An RPA bot can toggle between multiple systems and move data to meet customer needs with minimal manual intervention. For example, the bot can collect and store accurate customer and product information enhancing team coordination and client retention.

Increase in data accuracy

By using RPA bots, an insurer can eliminate potential human error. Furthermore, the reliability of data plays a major role in regulatory compliance. For instance, using optical character recognition, an insurer can automatically scan content from registration forms and move it into the relevant systems accurately.

Increased cost savings

By letting RPA bots take over the mundane tasks, insurance companies can reduce operational expenses of long working hours. In addition, employees can focus on revenue generating tasks which increases business productivity.

Increased level of job satisfaction

Using cloud based claims processing eliminates the need for manual data entry (as mentioned above), so employees can focus on more interesting and strategic work that adds more value and satisfaction. It helps insurance companies in maintaining a low employee turnover rate. For instance, RPA technology can pull the relevant information from different sources and enter it into the relevant system making it much easier for insurance agents to store and access accurate data when needed.

Why choose Electroneek’s RPA services

ElectroNeek is a top RPA solutions provider that assesses everything right from planning to adopting RPA and making sure the program is scalable across your organization’s functions. The company delivers automated end-to-end claims processing through a powerful integrated platform that will help your business thrive. With the advanced RPA tools provided by ElectroNeek you can automate actions down to the mouse and keyboard levels with minimal coding.

One of the most tricky aspects of claims processing is the use of legacy systems. With ElectroNeek’s RPA tools, you can update the data stored in such systems and efficiently connect them with your current infrastructure.

Choosing the right vendor is a critical aspect of successfully implementing RPA solutions to your insurance claims processing workflow. Click here to book a demo with the ElectroNeek support team to learn more.