UPDATED: January 2024

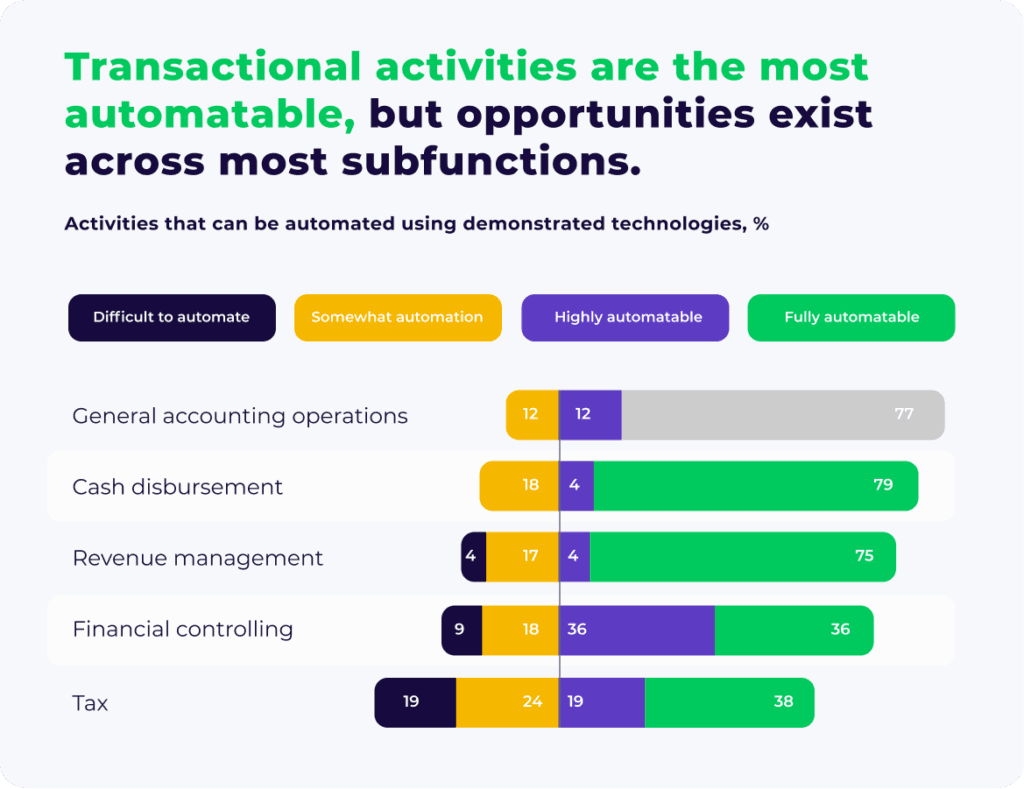

According to the McKinsey Global Institute's automation research, intelligent automation technologies can fully automate 42% of finance and accounting activities.

In addition, RPA in accounting increases visibility into financial operations since it automates the end-to-end process, from data entry and report generation.

Technology has revolutionized the financial process, making it easier and more accurate than ever. By introducing accounting automation software into an organization's operations, costly manual processes can be eliminated while freeing time to focus on higher-level goals!

Could automating finance be a time-saving game changer for you and your clients?

The Benefits of Using RPA in Finance and Accounting

RPA provides significant benefits when there are considerable time and money savings, and it’s crucial to crunch some numbers and evaluate the ROI first.

Finance is a business function brimming with exciting automation opportunities! We already know its processes are rule-based and standardized, making it the perfect environment for automated systems.

It's also filled with repetitive tasks which can be offloaded by computers - freeing up time to focus on more important matters like decision-making than manual data entry and record keeping.

Who knew finance could be so revolutionary?!

Benefits of RPA in Finance and Accounting

| Improved operational metrics and SLA | Higher accuracy and compliance | Increased employee productivity | More transparency and fewer risks |

| Leverage metrics from sales outstanding, inventory, and much more. | Automate invoice processing 24/7 with no errors. | Less turnover from burnout and lower hiring costs. | Streamline financial processes, and mitigate data safety and regulatory risks. |

Powerful no-code RPA platforms offer solutions that solve data extraction and system integration issues. So, let’s look at the ten most popular RPA use cases in finance and accounting.

#1. Accounts Receivable

Accounts Receivable is the perfect starting point to kick off automation in finance, as it’s less reliant on external documents than Accounts Payable. The primary metric RPA can help leverage here is Days Sales Outstanding.

DSO depends on the human element on both the payee’s and the recipient’s side. For example, an accountant may forget to send an invoice, and if this becomes an everyday occurrence, it jeopardizes the order to cash process and impacts liquidity.

Adopt RPA bots as your digital workforce, and they will issue and email invoices automatically. Automating this task will ensure a consistent cash flow without errors.

Besides eliminating cash gaps, RPA can help input information, sparing accountants from juggling multiple information systems and tedious tasks. Here is a list of possible accounts receivable tasks and processes that can benefit from intelligent automation:

RPA in Accounts Receivable

- Customer data setup and management

- Extracting customer information from different sources

- Sales quotation and entry generation

- Invoice generation and distribution

- Cash application

- Customer credit monitoring

- Dispute resolution

- Follow-ups, reminders, and dunning

- Credit risk management

- Chargeback

#2. Accounts Payable and Procure to Pay

The metric robotic process automation can help you boost here is Days Payable Outstanding. A high DPO is good when friendly credit terms trigger it, but late payments can affect it negatively.

Operational lags in accounts payable usually occur while processing invoices. Vendor invoices need to be standardized and cross-checked with purchasing orders and approved. Intelligent automation can streamline this process end-to-end, even if the incoming docs are paper-based, thanks to optical character recognition technology (OCR).

Software robots can direct invoices to the team member responsible for their approval and set up reminders. They can also match the purchase order with the invoice, compare them, and flag the mismatches (if any) for review.

Here are some examples of what RPA can do in accounts payable and procure to pay:

RPA in Accounts Payable and Procure to Pay

- Vendor verification and setup

- Purchase order entry

- Extracting data from invoices and purchase orders

- Vendor invoice processing

- Cross-checking invoices with purchase orders

- Preparing and performing payments

- Payment validation and reconciliation

- Expense compliance audit

- Monitoring duplicates

- Responding to vendor inquiries

#3. Intercompany Reconciliations (ICR)

Another good application point for RPA in finance and accounting is intercompany reconciliations. Balancing accounts to provide an accurate financial statement is a source of constant stress due to manual data entry, extraction, and cross-checking. In the worst cases, identifying unrecorded transactions or balances and rooting out invoicing mistakes can paralyze the entire department.

A bot can streamline this process by quickly acquiring and checking transactional data from any source, automatically approving all matching records, and notifying about discrepancies. By adopting RPA, you can automate and streamline the following tasks and operations:

Intercompany Reconciliations (ICR)

- Extracting or retrieving data from files

- Searching for related statements in ERP systems

- Comparing balances

- Looking for missing invoices and sending emails to customers

- Reporting discrepancies

- Directing reports to the business controller

- Creating journal entries

#4. Inventory Management

Inventory management is an essential function that maintains a constant product supply. RPA bots can do all the heavy lifting and help leverage the dead stock and stock-outs, improve lead times, and optimize storage costs.

These are the tasks software bots can transform:

Inventory Management

- Monitoring inventory

- Notifying about low inventory levels

- Ordering products when the stock levels hit a threshold

- Placing and approving stock orders

- Forecasting optimal inventory levels

- Updating ERP and WMS systems

- Reporting and follow-ups

- Tracking shipments

#5. Travel and Expenses

Regarding travel and expenses, RPA bots can facilitate lots of manual work for travelers and accountants, creating a better employee experience. They can extract and read data from all receipts, check whether they qualify as a business expense, and wrap them into accurate expense reports— with zero time spent on the part of the employees involved.

Travel and Expenses

- Entering expense records and checking according to company policies and legislation

- Aggregating data into expense reports

- Creating paychecks and managing benefits and reimbursements

- Alerting in case of policy violations or data discrepancies

ElectroNeek Recipe for RPA Accounting

ElectroNeek's Automation Hub offers recipes to empower you to deliver value to your clients quickly and easily. Recipe tutorials can help you hit the ground running so you can implement finance and accounting automation for your clients to help them optimize essential processes in their businesses.

Recipe: Reporting automation

As business operations become more data-driven, the management’s need for timely access to data creates a burden. Many office employees spend hours collecting data and performing repetitive actions to create reports.

Building a report requires significant manual effort from employees, and reporting may not be provided often enough for the best results and accuracy. RPA can construct efficient reporting workflows that help employees stay focused on their core competencies and enhance overall efficiency.

The bots built on the ElectroNeek Platform replicate user actions for any repeatable data collection from any digital source, whether a spreadsheet, SaaS tool, or a PDF document in a local folder. The same bot can perform rule-based analysis on the gathered data, format output, and produce complex reports.

Help Growing Businesses with Accounting Automation

With technology transforming our business, finance departments feel pressure to keep up or be left behind. How can smaller financial and accounting teams become more efficient with ever-increasing workloads? Intelligent automation may provide an answer - even without extensive changes to their infrastructure!

Book a demo if you’d like to discuss particular finance and accounting use cases and learn more about the ElectroNeek AI RPA platform.