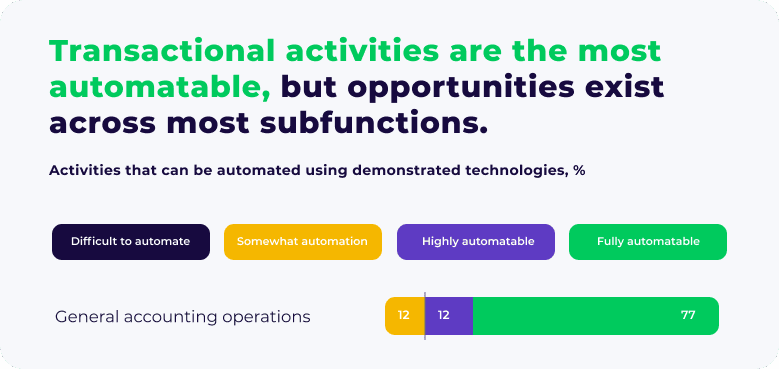

According to the McKinsey Global Institute's automation research, current automation technologies can fully automate 77% of general accounting activities.

How many of your clients have experienced operational slowdowns due to manual accounting tasks?

You do not have to be an accounting firm; all businesses must handle their day-to-day financial transactions and reporting, and many do this manually.

Businesses everywhere must sift through large amounts of financial data, many of whom just do not have the time or the resources to hire a finance team. And even if your company has a finance department, come tax season, they are sure to be inundated with the volume of last year's numbers.

RPA increases visibility into financial operations since it automates the end-to-end process, from data entry to reporting generation.

That is precisely what ElectroNeek client, Hiline found when it began automating accounting and finance activities. Brian Cohen states, “when we automated our data collection and reporting, we could access and leverage more data than ever before. This gave us more visibility into our business to make key decisions.”

Learn how the ElectroNeek RPA platform can help you deploy bots for internal accounting and help your current clients streamline accounting operations.

The Benefits of Using RPA in Finance and Accounting

Accuracy in highly repetitive tasks in the accounting industry is essential for success, yet these activities are both time-consuming and tedious.

Financial accounting is notorious for error-prone processes, which makes accounting one of the most exciting industries to automate processes - the benefits are limitless!

After implementation, robotic process automation will result in an observable return on investment through various benefits.

Automating your accounting operations internally yields the following benefits:

Benefits of RPA in Accounting

| Faster Data Entry | Streamlined Invoice Management | Leverage Accurate Data | Improved Compliance |

| Automate data entry for faster and more efficient error-free data entry. | Automate invoice processing 24/7 with no errors. | Prevent employee errors in master data sets and automatically generate reports. | Create rule-based systems to approve or flag issues automatically. |

You can implement time-saving accounting automations internally, reap the benefits of increased efficiency, and turn around and automate for your clients to build recurring revenue streams.

Could RPA offer solutions that solve data extraction and system integration issues for you and your clients?

Let’s dive into the five most popular RPA use cases in finance and accounting.

#1. Payroll

Do you want to avoid payment delays and inaccuracies when processing payroll?

RPA bots enter data in timesheets, validate timesheets, and calculate payments for payroll activities. The bots even extract data from paper sick lists that some organizations still use.

The bot logs into business accounting systems to collect the data. Once logged in, it reconciles the actual hours worked and the budgeted hours and notifies management of any variations by email.

The bot processes earnings and deductions, executes tax reconciliations, and generates reports detailing benefits taken out.

These are the use cases RPA can help you or your clients with:

Payroll

- Employee data extraction

- Entering data into timesheets and systems

- Data verification across information systems (sick days, business trips, timesheets)

- Generating and approving timesheets

- Email notifications for completed reports or issues

#2. Tax Reporting

Do you want to comply with processing and calculating taxes?

Though the central part of this business process is in tax compliance software, finance teams still perform time-consuming manual calculations.

Instead of sorting through data and manually generating reports, you can leverage bots to automate this process entirely.

RPA bots produce reports in the following formats: spreadsheets, documents, and PDFs. The bot uploads the specified data to any system and automatically distributes reports through email or messaging.

Quickly deploy on any infrastructure to eliminate manual reporting and increase reporting speed and accuracy.

Bots provide a fast and efficient way to access data from legacy IT systems and SaaS tools with limited API integration. With RPA bots, you can generate any report related to project management, sales, operations, digital marketing, and social media.

Automated data capture – made simple.

RPA robots can automate this part by taking over:

Taxes

- Gathering data for tax liability

- Creating tax basis

- Preparing reports

- Updating tax return workbooks

- Submitting reports to tax authorities

#3. Treasury Reporting

Do you or your clients need support for Treasury reporting systems?

Though sophisticated information systems exist, many businesses struggle with manual data entry to ensure treasury systems are fully updated.

RPA bots can extract and format data into the appropriate reports and update the necessary information in systems.

You can even automate sending reports, so no more emailing!

Bots can extract and transform data into a format a treasury system can process, and even more:

Treasury

- Extracting and formatting data

- Updating treasury systems

- Sending out reports

- General ledger updates

#4. Financial reporting

Are you currently tracking your financials to monitor P&L?

If so, you know that financial reporting tasks are time-consuming but essential to business operations.

RPA takes this task off your shoulders and generates detailed reports in real-time. Such intelligent automation will make your business processes more transparent and ensure financial forecasting accuracy without wasting resources.

There are many scenarios where RPA helps with financial reporting tasks, such as:

Financial Reporting

- Trial balance and balance sheets

- Income statements

- Profit and loss statements

- Variance analysis

- Financial close processes

- Regulatory/management reports

#5. Financial Planning and Forecasting

Did you know that you can leverage RPA bots to assist with financial planning and forecasting?

Many routine processes in financial functions are done manually by employees.

Now, you can control your company’s future through accurate financial planning through automation.

Bots load balances to planning systems and create variance reports. Based on this information and historical data, modern RPA platforms can also provide forecasts and help improve financial planning.

Here are some exciting examples of what the bot can help with when it comes to financial planning:

Financial Planning and Forecasting

- Loading balances to planning systems

- Creating variances reports

- Providing financial forecasts

ElectroNeek Recipe for Streamlined Accounting Automation

ElectroNeek's Automation Hub offers recipes to empower MSPs and IT Service Providers to deliver unlimited bots to your clients quickly without having coding experience.

Recipe bots can help you hit the ground running to implement finance and accounting automation proofs-of-concept in a few days.

Recipe: How to transfer data from a spreadsheet to the web

This ElectroNeek tutorial showcases transferring data from a spreadsheet to a web application. Data entry from spreadsheets into financial systems is typical for accounting tasks.

Unlock the Power of Automated Accounting with ElectroNeek

No matter how large or small your clients' accounting department is; it's essential as an MSP or IT Service Provider you keep them advancing in digital times. By providing a few simple steps towards automation with ElectroNeek recipes, you can easily stay ahead of enterprise-focused firms competing in today’s market - clearly showing that size doesn't always win when it comes to recurring revenue success!

If you’d like to talk about RPA in finance and accounting in your or your client’s accounting department and learn more about ElectroNeek Recipes, book a demo.