Tax professionals deal with digital technologies and complex rules that constantly change the way they work. These taxation professionals typically must then take those new bits of technology, and balance them with the mundane tasks that fill up significant parts of their day, all while meeting management expectations.

Typical tax functions involve combining a phenomenal volume of data that employees need to analyze and prepare reports. Increasing the number of employees to solve this issue may not be a viable solution. Here, robotic process automation (RPA) can assist in performing various tax functions, shifting employees' focus to performing intellectual tasks, reducing the cost of performing routine operations with fewer errors in processes, speedy execution, and higher quality leading to reduced audit risk.

Benefits of tax automation

Working with various tax systems, counterparties, and commodity nomenclature requires special attention as the likelihood of mistakes are very high. Without automation, certified professional accountants (CPAs) run the risk of making errors when working with different tax systems that result in financial losses for the company (to pay off penalties). Automating tax processes enables them to eliminate the occurrence of discrepancies and shortcomings.

Below are a few benefits of tax automation that help companies avoid headaches associated with manual calculations.

Improved accuracy

The bots perform the job faster and execute the processes accurately, eliminating the risk of errors that occur during manual data entry. Plus, bots can also detect anomalies in datasets and inform the relevant employee promptly.

Shift to high-value work

Tax automation not only speeds up processes and improves employee productivity, but it is also shifting the focus of employees to performing intellectual tasks such as judgements, estimates, complex transactions, and other business models, making human labor more valuable than ever.

Data processing efficiency

Bots can complete the work that an employee finishes in hours within minutes. Bots can process large amounts of documents, perform data extraction (PDF, OCR, emails) and entry in the tax software, make calculations, consolidate the results, and prepare reports offering updated information every time.

Accelerated tax provision timing

Gathering data is one of the most time-consuming challenges. It can be addressed through tax workflow automation to meet the high demands of financial reporting. The bots can assist tax professionals to cover the broad spectrum of services such as annual and interim tax provision, tax audit management, and compliance and offer just-in-time support.

Leverage RPA in your tax processes: what can you automate?

RPA affords companies numerous benefits in the form of tax automation. Discover ten use cases below to learn how automated bots can reduce your tax office’s pain points, remove the mundane tasks tax professionals despise, and ultimately, create revenue and growth opportunities.

Reporting

When preparing tax reporting, employees find it challenging to collect accurate and update data when working manually with multiple sources/financial accounts. Working with manual Excel sheets for interim provision calculations can impact the quality and accuracy of reports. Employees often use emails excessively to know the project's status due to disconnected financial systems and processes, which is time-consuming.

Tax automation makes it possible to increase the efficiency of tax reporting preparation and introduce automatic control procedures for its verification, reducing the cost of preparing tax reports and performing other tasks of the tax function.

Billing and invoice generation

When it comes to billing and invoice generation, the typical issue employees face is the time this process takes. For instance, they have to go through emails, fax, and postal mail to view and gather the invoices and enter the data into the software. Plus, invoices need to be associated with the corresponding purchase order, and after that, these are sent for approval/validation. Then, the verified invoice data is entered into the accounting software. This entire process is slow and expensive, especially for enterprises.

Automating the billing and invoicing process offers several benefits: efficient use of the company's resources, faster processing times, and reduced costs related explicitly to manual handling of invoices (multiple handling of one invoice, misfiling, misplaced document).

Compliance tracking

Compliance officers have high pressure placed upon them by the top management, regulators, and other stakeholders who depend on them to do their jobs well. Compliance tracking is a multi-step process where employees need to organize and monitor information related to compliance (or tally up numbers of a spreadsheet) so that no information falls through the cracks.

Companies considering tax workflow automation can simplify this process too. The bots adhere to the security standards, verify compliance requirements, perform quality checks, and promptly notify the supervisor about any reporting mistake or highlight any non-compliant process. Compared to manual controls, the RPA tax, i.e., bots explicitly designed for the tax function, will keep track of all resources allowing tax professionals to access real-time data and prepare reports for decision making.

Collecting data

Aggregating, processing, and making the correct information available is a big concern for tax teams because a tiny mistake can result in considerable inaccuracy and put a company at greater risk. Entrusting this process to bots will lift the stress off the shoulders of tax professionals as the bots will provide the real-time data for good visibility of activities.

Automated data collection means bots are extracting structured and unstructured data from multiple accounting and ERP systems (such as sales and purchase ledgers) and processing it into a standardized format before uploading it into the tax software. Tax professionals can easily access this data to perform analytics.

Tax calculations

The main reason tax calculation is complex and tedious is the amount of data tax professionals have to download and process. Though employees rely on tax software for calculations, they are still using manual spreadsheets. By deploying bots with the software, companies can accelerate the tax calculation process and avoid potential mistakes/guesswork. They will take care of all the tax-related formalities according to the predefined rules and rates and calculate the tax.

For instance, if an e-commerce business wants to automate sales tax calculation, it can benefit from RPA for tax, i.e., bots across multiple platforms like PayPal, Shopify to organize its Sales tax data. By deploying bots, companies can ensure compliance with the tax reporting requirements, accurate rate calculations, and timely fulfilling of tax obligations.

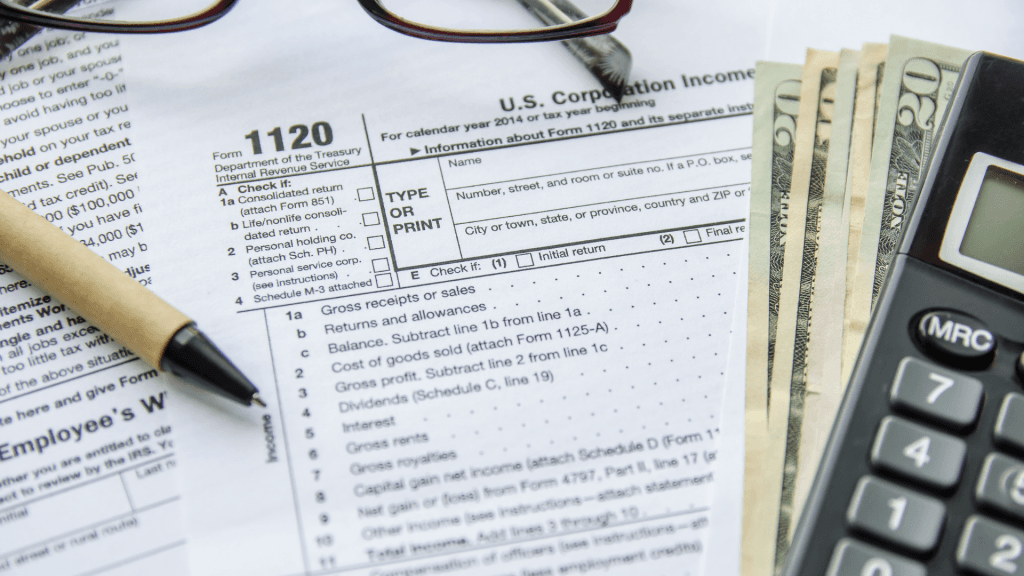

Reviewing tax returns

Tax professionals rely on checklists, follow the exact steps/instructions, and work their way to gather the documents and information before preparing for a tax return. These repetitive reviewing steps are prone to human error, and companies should leverage RPA to use their high-expertise professionals' time better.

When following the standardized review procedures, no expertise is required. Here bots can save employees' hours and hours of work; they will navigate through the tax software to verify the tax return was accurately prepared. Another application of RPA can be automating the filing income tax extensions, a task that tax professionals frequently find themselves tasked with.

Tax workflow automation systems differ in terms of features and functions, so you should use one like the ElectroNeek RPA platform that easily integrates with various tax preparation systems/applications.

Uploading data to tax software

When filing tax forms, employees switch among multiple sources to manually map data to relevant fields. In this process, a simple data entry error or inefficient tax documents management will prolong the time to complete this task.

It is where automation comes to the rescue; automated data entry to gather and transfer data without multiple logging into the tax management software and replicating it across multiple forms with human involvement. Additionally, bots will generate reports after task completion and notify stakeholders by email or messenger.

Tax returns filing status updates

After filing tax return extensions, employees have to monitor the return's acceptance status for clients constantly. Once the e-filing is accepted, they will manually upload the acceptance confirmation into the CRM and client's portal (and notify him via email) and compile reports after task completion. This process is repetitive and rule-based, making it a perfect candidate for automation.

From creating new client accounts in the software to extracting their details from tax forms for submission and compiling the status reports, the bots can execute these tasks on various applications. The speed, accuracy, and efficiency of the robotic process automation tax software also motivate clients to pass their data for tax return filing confidently.

Annual tax questionnaire processing

When preparing the local, federal, or state tax returns, accounting firms need to gather information, such as a client's financial accounts. Manual gathering and organizing these questionnaires is another time-consuming aspect of tax returns filing. Using an RPA tool will eliminate errors and free up many hours of employees' productive time.

One key benefit of automating the tax questionnaire process is that exchanging documents/files is on both sides (means for the client's portal too). All the documents will be automatically sorted in a sequence or bookmarked, which establishes an excellent method of organizing tax documents across the firm.

Filing income tax extensions

Another application of RPA can be automating the filing income tax extensions, a task that tax professionals frequently find themselves tasked with. Accounting firms handle large volume e-filed extensions with different sets of rules for each client (state or local tax regulations). The bots will do the heavy lifting automatically and accurately in the background for every extension.

The bot will launch the software and enter data to extend the tax return when triggered by an automated workflow. Depending on the client's state law, it will also determine the need to file additional local or state tax returns and update the client's status. Once the e-filing is accepted, copies the acceptance confirmation to the client's file and notify the relevant employee accordingly.

Build an efficient and well-integrated tax expertise with ElectroNeek

Manual data handling increases execution time, chances of errors, and resource investment. Companies can leverage the RPA tools to transform the tax function by combining the efficiency of their tools with the intelligence and judgment of humans.

The future tax function is data-driven and operates in real-time, where bots and humans collaborate to provide valuable insights to the business. ElectroNeek RPA solution can help you automate the recurring and data-wrangling tax processes by saving time for purposeful and strategic work.

If you would like to know which processes can be automated for effective tax planning, book a demo to see how easily our RPA tools work with your software.