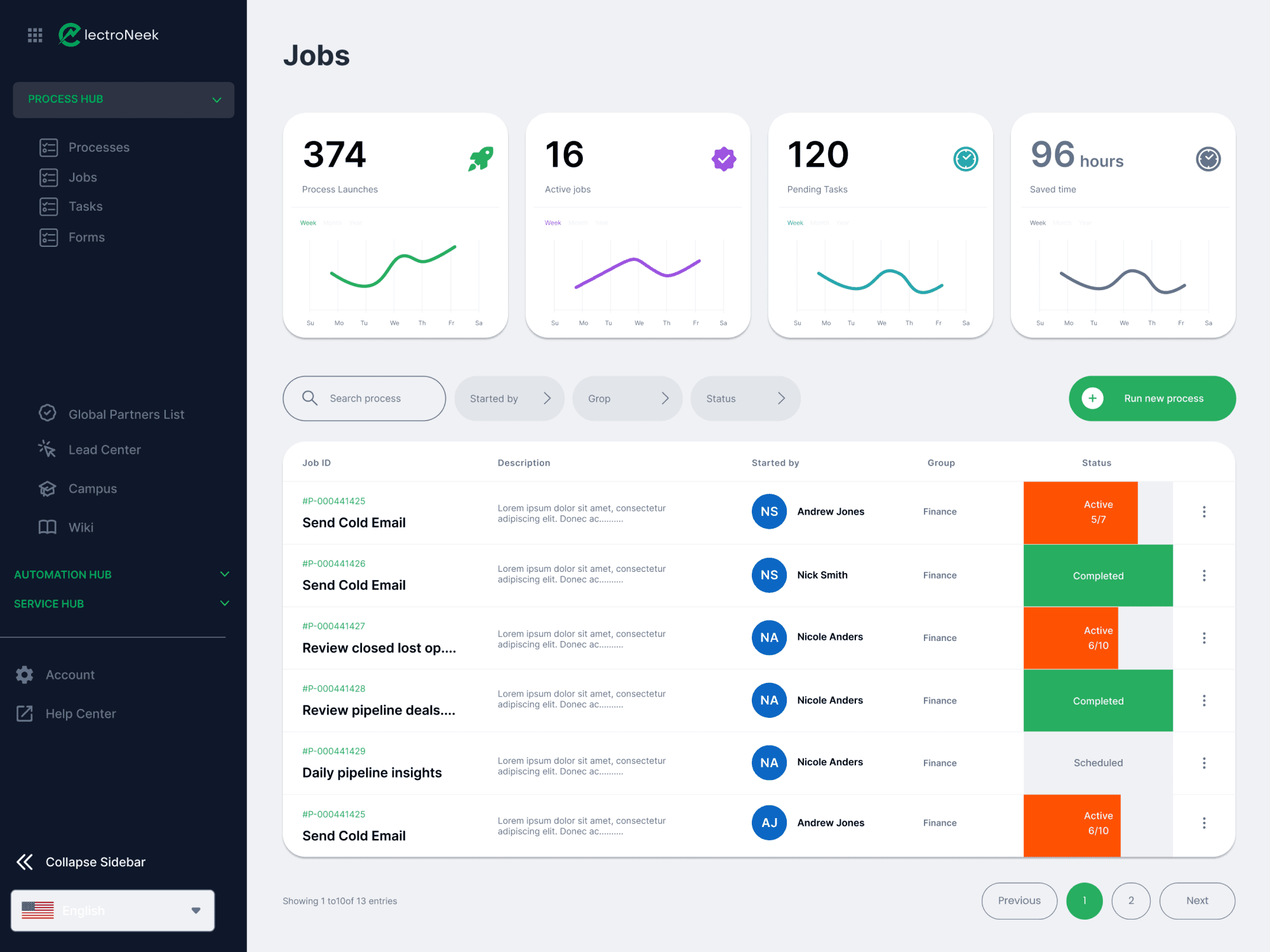

Workflow Automation Platform: Your Enterprise IT Glue

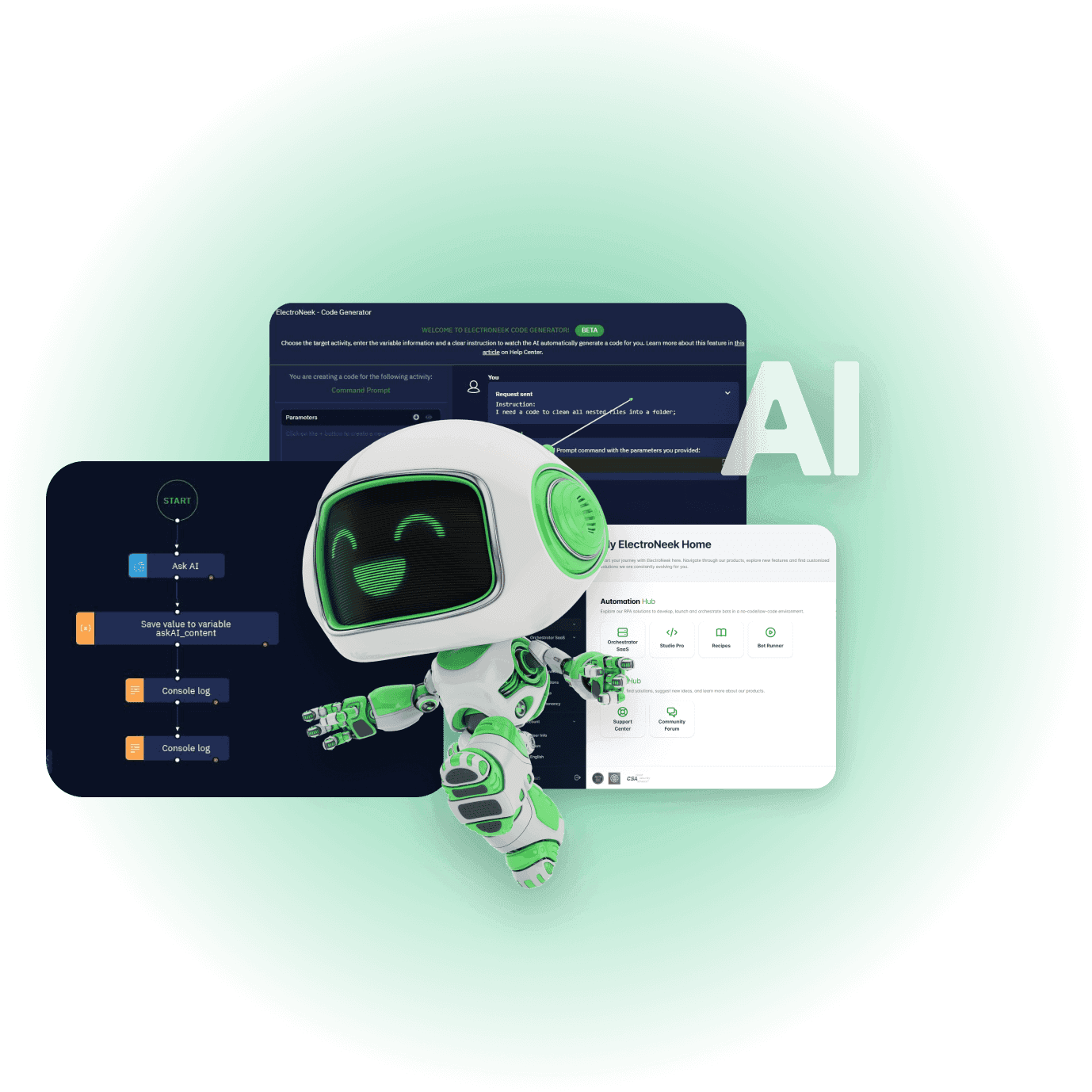

Connect, Integrate and Automate to unlock unlimited efficiency gains for your repetitive business processes. Robotic Process Automation and Document Processing made easy to use with the power of AI.

Our Enterprise customers run 1M+ workflows a month, saving thousands of hours of their employee time. Join them today.

Design And Automate Processes You Manage

Process Management

Build easily manageable processes, assign steps for employees and automations

Robotic Process Automation

Automate workflows of any complexity in desktop applications, websites and SaaS tools

Document Processing

With a click, automate data extraction from 3000 document types in 80+ languages

Easley AI

Turn process step into automation by just describing what your want to do with words

Integration

Native integration with 500+ applications to automate any work.

“The interface is efficient and intuitive. The support has been exceptional while getting started with the product. Our first proof of concept was easy to create and we worked through the full implementation confident that we’ve made a good choice with ElectroNeek.”

Keith Cote

VP of IT | UFP Technology

All your tools in one place

ElectroNeek works with the platforms you’re already using, streamlining the way you work

on 2023 Inc. 5000 List

What our customers are saying about their ElectroNeek AI Bot experience?

Use Cases

See more >

Automated Delisting Workflow Supports E-commerce Business Growth

Read more >

Revolutionizing the Construction Industry with Automated Data Scraping

Read more >

Evangelizing Intelligent Automation Benefits

Read more >

Automating Repetitive Tasks to Drive Innovation and Revenue Growth in the Healthcare Industry

Read more >Love Intelligent Automation with ElectroNeek?

Become a Partner

If you like working with clients and helping them make their small businesses even better, our Partner Program could be for you.

ElectroNeek helps you succeed with Intelligent RPA Bot Automation

Documentation Center

Get answers to all your questions about the ElectroNeek platform and AI bots.

Free Education

Access our library of free product training learning materials that will help you get up to speed on Intelligent RPA Bot Automation.

Business Insights Blog

Stay up to date on the latest trends and best practices for implementing Intelligent Automation, RPA, AI Bots, GPT, and more.

Still have questions about ElectroNeek's Intelligent Automation platform?

We’ve had a lot of success with all types of business use cases. Tell us about yours.